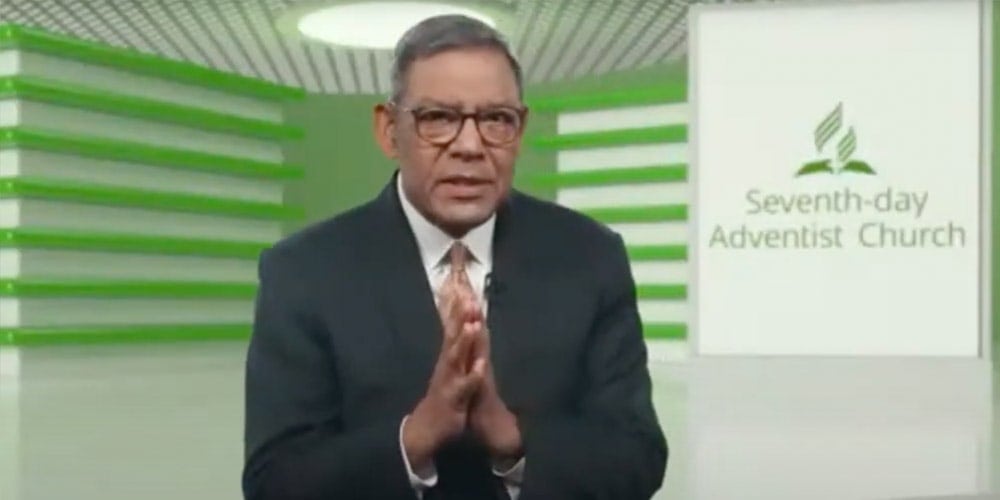

In a year often described as “unexpected,” “unpredictable,” and “uncertain,” Adventist Church treasurer Juan Prestol-Puesán reported that the finances of the Seventh-day Adventist Church broke even in 2020.

Prestol-Puesán’s remarks were part of his April 13, 2021 report to members of the General Conference Executive Committee (GC EXCOM) the highest decision-making body of the denomination between quinquennial world sessions. Committee members from around the globe are meeting virtually for the 2021 Spring Council.

Prestol-Puesán recounted the challenges of the past year. The financial reports during the start of the pandemic looked troubling, but as the summer ended and fall began, the reports trended steadily upward. It was in November that he raised a special prayer. “I prayed to the Lord to allow us to simply break even for the year 2020, and I expressed that reaching a break-even, or even showing US$10,000 above break-even, would be like a dream come true,” he shared. “Today, I wish to inform you that my wild dream materialized, and my prayer was answered more generously than I thought.” Prestol-Puesán reported that the net assets of the church experienced an increase of US$67,816, or, in his words, “more than six times what I asked the Lord to provide.”

Careful Management

Beyond the essential role of God’s blessings, a positive result wouldn’t have been possible but for the careful management of resources and sources of income, Prestol-Puesán emphasized. “The financial operations of the General Conference have been managed prudently,” he said. Among other elements, he emphasized that expenses were deliberately reduced. Prestol-Puesán also cited reductions in personnel, the elimination of some in-house services, and the avoidance of unnecessary costs as elements that made the financial picture positive.

“If expenses had not been cut down, the possibility of breaking even would not have occurred,” he acknowledged. Remarkably, tithe income from the North American region, which accounts for almost half of the General Conference budget, rose 1.7 percent in 2020 compared to 2019.

As finances became more stable in the second half of 2020, other emergency measures did not need to be enforced, Prestol-Puesán explained. “Appropriations to divisions and institutions, as well as to the 10/40 Window, were not reduced,” he said, referencing the predetermined amounts of money that support the mission work of the church in regions where Christianity is a minority faith. Also, allocations to some of these entities that were suspended by an Executive Committee action voted on July 9, 2020, were partially restored in December. These measures helped the ending balances for funds servicing Adventist missionaries overseas, auditing services, and the Geoscience Research Institute.

“Twenty-twenty ended as unpredictable and uncertain as it began, but the Lord was with us,” Prestol-Puesán said. “He made the difference by adding His blessing to our humble efforts.”

Encouraging Signs

As part of the financial report, undertreasurer Ray Wahlen amplified the treasurer’s presentation with data supporting the encouraging results in 2020.

Worldwide, tithes — the 10 percent of income that church members voluntarily return to fund the mission of the church — decreased US$128 million in 2020, or 5.3 percent. The reduction was likely caused by global financial instability and significant exchange rate fluctuations of major currencies compared to the U.S. dollar, Wahlen explained. A tithe reduction directly affects the operations at the church headquarters, which, by policy, operates on a cap of 2 percent of global tithes. In this case, it meant that the General Conference received US$2.7 million less for its operations in 2020, Wahlen said.

“We started 2020 with an approved in-house budget of slightly more than US$50 million,” Wahlen explained. “With the sudden changes happening in the early months of the year, the General Conference took measured steps to reduce its operating budget to US$46.5 million. These cuts were painful,” he acknowledged.

Wahlen said, however, that the collaborative approach adopted by the entire General Conference staff resulted in significantly more savings than projected. “Departments looked proactively at their plans and either postponed many of them, or in some cases canceled them completely,” Wahlen reported. The result, he said, was that in 2020, expenses amounted to US$37.9 million — US$7.7 million less than the actual cap and US$12.1 million less than the original budget for the year. “Viewed in another way, expenses amounted to just 83.2 percent of the allowable limit,” he said.

Overall, exchange rate fluctuations, reduced returns on investments, and other factors meant a total US$29.9 million decrease in income in 2020, offset by reducing expenses US$17.1 million and shifting transfers by US$7.1 million. “It meant US$5.7 million less than 2019 but still slightly more than break-even for the year,” Wahlen reported.

Challenges Ahead

Prestol-Puesán acknowledged that the 2020 fiscal year left his financial team with “plenty of warning against careless management and cautioned us about being overconfident in 2021 and beyond.” In 2021, he added, the General Conference expects to catch up in several areas, including returning to allocations at pre-COVID-19 levels, if possible, and completing unfinished mission and logistics initiatives.

An unfinished challenge, both Prestol-Puesán and Wahlen acknowledged, is for the global church to bounce back from a substantial decrease in mission offerings, the contributions church members make to mission projects around the world. In 2020, mission offerings decreased US$14.9 million (or 20 percent) compared to 2019. Wahlen said that the church’s mission offerings merit “urgent, comprehensive study” to determine the causes for the decline. Possible causes include changing attitudes about donations to the mission and creating opportunities for mission giving when on-site worship services are canceled, he said.

Noting continuing challenges and uncertainties, Prestol-Puesán nonetheless expressed the financial team’s awareness that they have seen the Lord’s blessings in 2020. “We wish to express our gratitude to Him for His faithfulness and His love,” he said.

A Personal Note

At the close of his report, Prestol-Puesán shared how a personal study on the end-time scenario known to Seventh-day Adventists as “last day events” helped him reflect on the importance of supporting the stated mission of the church. Quoting advice offered by Adventist Church co-founder Ellen G. White in The Review and Herald (now Adventist Review) on March 21, 1878, he reminded his listeners of divine direction in making financial decisions. If church leaders and members desired to be taught how to best use their properties to support God’s work, God would teach them “when to sell and how much to sell” instead of hoarding. “Hoarded wealth will soon be worthless,” White wrote.

To illustrate his point, he recounted how, as the financial team was closing accounts for 2020, he was notified that the General Conference had received a few large and unexpected donations for mission work from individuals previously unknown. The donations were in the millions of dollars, he shared. For Prestol-Puesán, this is just a foretaste of what will happen as Adventists approach what they believe is the end of days. “I am grateful,” he said, “that in 2020 the Lord allowed me to have a glimpse of what will likely happen at the very end of mission.”

At the end of Prestol-Puesán’s report, Adventist Church president Ted N. C. Wilson celebrated the positive financial outcomes amid the ongoing pandemic. “I think that the only thing we can say is ‘Praise be to God.’”

GC EXCOM members voted to receive the Treasurer’s Report 172 to 1.